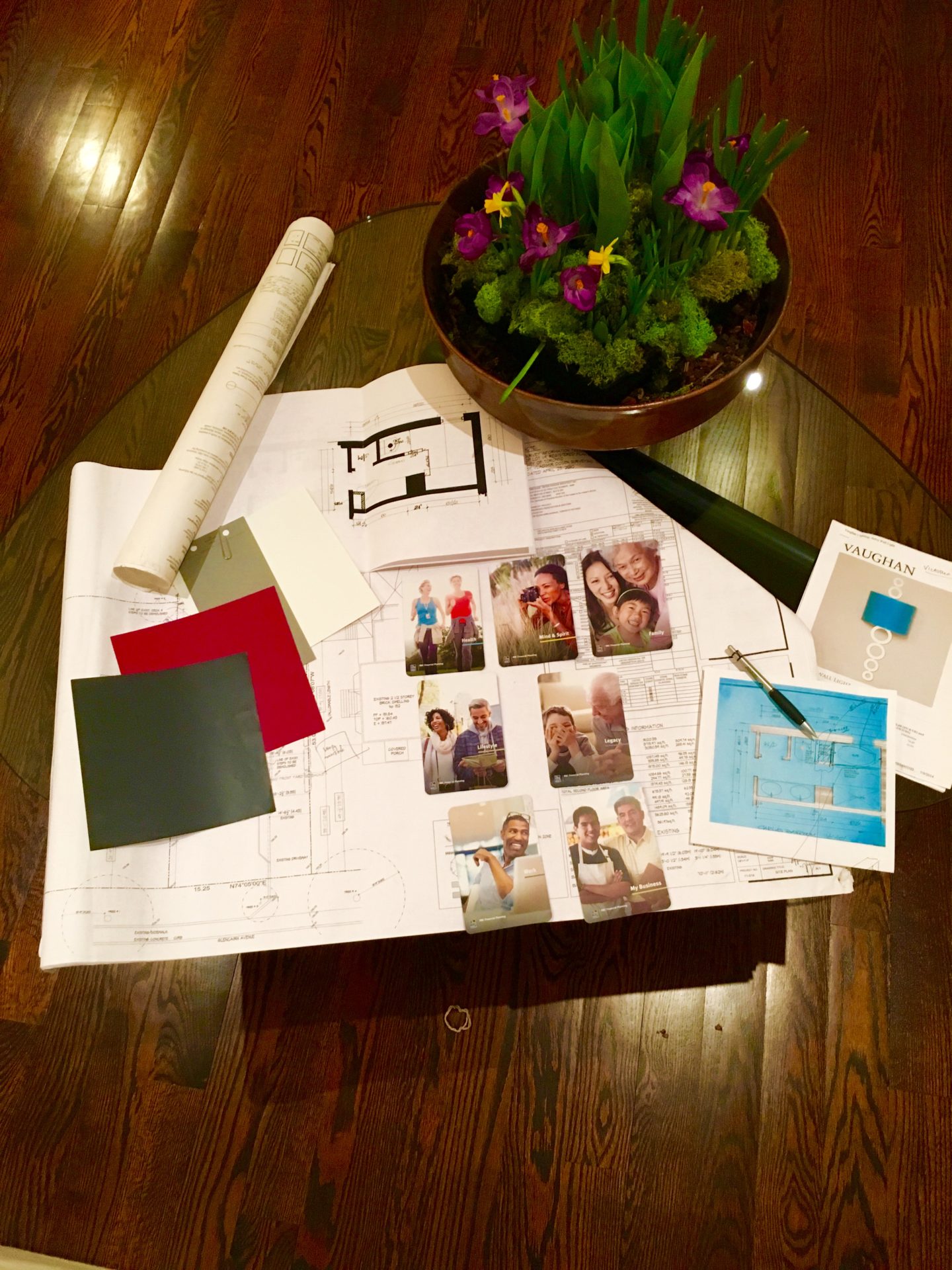

When I was first approached to partner with RBC, I couldn’t understand what the fit would be from the perspective of an interior designer. I was directed to RBC’s Your Future By Design website, which I found to be a very interesting part of design I hadn’t really thought of before.

The philosophy they’re espousing suggests you should really think what the picture of your retirement will look like, not how you’re going to finance it. Start going crazy with your dreams, your hopes and your wishes and then figure out what you can financially support afterwards. Thinking about how long you’re going to have to work or how much money you’ll have to save blocks you from picturing what you really want, even something as basic as where you’re going to live.

Do you have to relocate or do you want to relocate? It’s a question many of us — even those closer to retirement age — haven’t considered. RBC’s recent survey found that 61 per cent of working Canadians aged 50 plus* expect to stay in their current home and 33 per cent plan on downsizing. Only six per cent plan on relocating to a retirement community. Regardless of where you live in retirement, your home should continue to meet your lifestyle needs over time and help you build a solid foundation.

Here are my three key considerations:

• Family and friends: You may decide to move 40 minutes away, but that means moving away from your loved ones and your whole support system you’ve grown up with. Forty minutes may not seem like a big deal, but it ends up being a lot farther than you think. If that’s what you decide, you need to plan for that.

• Home maintenance: Upkeep is a huge decision. You may decide to deal with the landscaping on your own or pay someone to come in and take care of it. You may have a lack of desire or, like me, just don’t want to do it.

• Mobility and accessibility: Stairs and bathtubs may not seem like obstacles today, but they can pose significant mobility issues later. Consider planning now and check how well your home will support accessibility and mobility for your later years.

Planning your home in retirement is much like the process of designing a home from scratch. Couples must work together to find the middle ground. The whole retirement process is about adjusting and communicating to ensure that each person’s desires and practical needs are taken into consideration. Each partner should start by listing his or her individual priorities, then compare. Where priorities differ from each other’s, a retirement designer can help to create a shared plan that you both agree on. More tools are available at www.retirementdesigners.ca.

Excellent points!